Using the right credit card can help you save money through rewards, cash back, low interest rates, and more. This article will discuss the top ten credit cards to maximize your savings and meet your financial goals.

1. Chase Freedom Unlimited

The Chase Freedom Unlimited offers an excellent 1.5% cash back on every purchase. There is no annual fee, and you can redeem rewards for any amount at any time for cash back or gift cards.

2. Citi Double Cash

The Citi Double Cash provides a 2% cash back rate – 1% when you make a purchase and 1% when you pay it off. No limit on how much cash back you can earn!

3. Bank of America Cash Rewards

The Bank of America Cash Rewards card offers 3% cash back on one category of your choosing, 2% at grocery stores and wholesale clubs, and 1% on other purchases.

4. Wells Fargo Active Cash

The Wells Fargo Active Cash provides an unlimited 2% cash rewards on purchases with no rotating categories or sign-up bonuses to keep track of.

5. Capital One SavorOne Rewards

The Capital One SavorOne offers 3% cash back on dining, entertainment, popular streaming services and at grocery stores, plus 1% on all other purchases.

6. Chase Sapphire Preferred

The Chase Sapphire Preferred offers 2x points on travel and dining purchases. Points can be redeemed for cash back, travel, gift cards, and more.

7. Discover it Cash Back

The Discover it Cash Back card provides 5% cash back in quarterly rotating bonus categories and 1% cash back on other purchases.

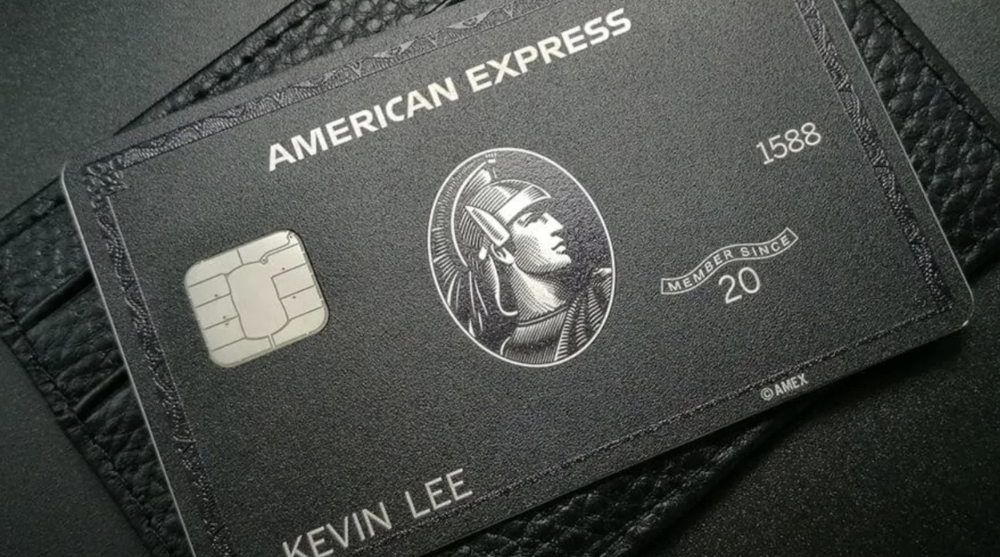

8. American Express Blue Cash Preferred

The Amex Blue Cash Preferred offers 6% cash back at grocery stores, 3% at gas stations and on transit, and 1% on other eligible purchases.

9. U.S. Bank Cash+ Visa Signature

The U.S. Bank Cash+ Visa allows you to choose 2 categories to earn 5% cash back on, including fast food, electronics stores, and more.

10. Bank of America Premium Rewards

The Bank of America Premium Rewards card offers 2x points on travel and dining purchases and 1.5x points at other purchases.

Conclusion:

Using a cash back or rewards credit card can help you keep more money in your wallet. Consider getting one of these top credit cards tailored to your spending habits. Just be sure to pay your balance in full each month and use it responsibly!